Council Members

Coming Soon...

Inaugural Office Bearers of TFAB

TFAB History

Trade Finance is one of the most important functions of commercial banks as they depend on this area of business to generate a substantial amount of their profits. Although the credit risk in trade finance is considered relatively low the operational risks are very high. The banks therefore deploy highly skilled staff to handle this area of their business. The staff members must be highly trained skilled staff who are very knowledgeable and possess the required skills which have to be updated regularly in order to be abreast of the developments in this dynamic area to be level with those in even the large international banks across the globe in order to deal with them effectively.

However, most banks in Sri Lanka did not have a coordinated approach in training their staff in this area. Therefore there was a need to have a mechanism to bridge this gap. Some senior bankers handling trade finance business thought it fit to form a body which could fulfill this need and thus, the Trade Finance Association of Bankers was formed.

The inauguration of the Association was held at the Hotel Taprobane (presently the Grand Oriental Hotel in Colombo Fort on 11 November 1997 with the Governor of the Central Bank of Sri Lanka, Mr. A.S. Jayawardena as the Chief Guest and the Resident Representative of the International Monetary Fund as the Guest of Honour who also delivered the keynote.

The following founder members were unanimously elected to the first Council of the Trade Finance Association of Bankers (TFAB).

| President : | Mr. A. Kathiravelupillai |

| Vice President : | Mr. Ernest Gunasekera |

| Secretary General : | Mr. Michael Peiris |

| Assistant Secretary : | Mr. Ananda Liyanage |

| Treasurer : | Mr. Jegan Durairathnam |

| Assistant Treasurer : | Mrs. Damayanthi Tillekeratne |

| Council Members : | Mr. Ravi Molligoda Mr. Parama Dharmawardene Mr. Lakshman Edward Mr. J.L.S. Liyanage Mr. Kumar Wickramarachchi Mrs. Preethi Jayawardena Mr. A.H. Bakshy |

Mr. Ravi Perera was elected the Honorary Auditor and Mr. Srilal Waidyatilleke was appointed the Editor of the association’s newsletter.

The membership of the Association was open to bankers who are serving or who have served in handling trade finance business who subscribe to the objects of the Association. The following were the principal objectives of the Association.

- To facilitate the exchange of views among members and other individuals and / or organizations on matters related to trade finance

- To promote consistency in trade finance practices among bankers

- To engage in educational activities for members and other practitioners of trade finance by holding lectures, seminars, workshops and other activities

- To assist members to further their learning and knowledge on matters relating to trade finance

- To publish a periodic journal / newsletter containing material relating to trade finance and other connected areas.

- To coordinate with any regulatory authority or other organizations on matters related to trade finance

- To promote goodwill, understanding and fellowship among bankers engaged in trade finance.

This year the Trade Finance Association of Bankers completes 20 years of dedicated and invaluable service to the international trade finance industr0y. It can be justifiably proud of its achievements during this period having performed a number of activities for the furtherance of its laid down objectives.

A Trade Seminar is conducted annually by TFAB catering to the bankers, importers, exporters, lawyers and businessmen in order to update their knowledge and skills to be abreast of the current global practices. The TFAB also conducts a series of Evening Lecture / Discussion programs by inviting eminent speakers to discuss topical subjects. Another important role that TFAB plays is having discussions with the various regularity authorities with a view to seeking clarifications on the various operating instructions issued from time to time as well as to iron out the practical issues that banks face in handling the international trade operations. TFAB also issue a Newsletter periodically to update the knowledge of the members with the latest developments. The other main event in the TFAB calendar is the Quiz and Social. The Quiz is designed to sharpen the skills and enhance the knowledge of the participants while the Social is aimed at fulfilling the objective of promoting goodwill, understanding and fellowship among bankers engaged in trade finance. Trade Cricket Sixes is also held annually with the objective of building comradeship among the members and providing networking opportunities.

We are delighted to mention that two of our members are the Chief Executives of two leading commercial banks in Sri Lanka today. It is envisaged that the TFAB will continue to play its pivotal role of developing people by enhancing the knowledge and sharpening the skills of trade practitioners involved in imports and exports business. We acknowledge with thanks the contribution made by the commercial banks which have been very supportive of the activities carried out by TFAB over the past twenty years and we look forward to their continued support and generosity in the future as well.

Inaugural Office Bearers of TFAB

-

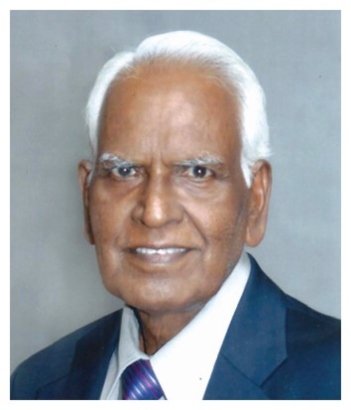

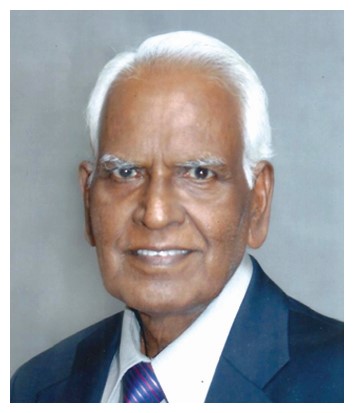

Mr. A. Kathiravelupillai

President

-

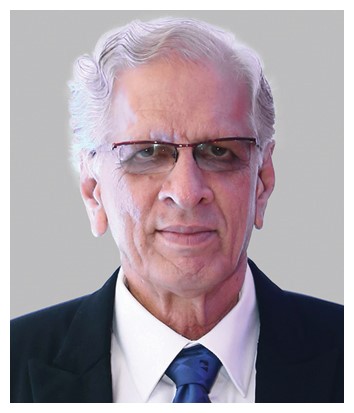

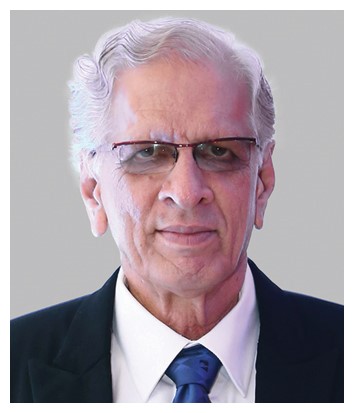

Mr. Ernest Gunasekera

Vice President

-

Mr. Michael Peiris

Secretary General

-

Mr. Ananda Liyanage

Assistant Secretary

-

Mr. Jegan Durairathnam

Treasurer

-

Mrs. Damayanthi Tillekeratne

Assistant Treasurer

Council Members

-

Mr. RaviMolligoda

Council Member

-

Mr. ParamaDharmawardene

Council Member

-

Mr. LakshmanEdward

Council Member

-

Mr. J. S. L.Liyanage

Council Member

-

Mr. KumarWickramarachchi

Council Member

-

Mrs. PreethiJayawardena

Council Member

-

Mr. A.H.Bakshy

Council Member

Past Presidents

-

Mr. A.Kathiravelupillai

1997/1998 & 1999/2000

-

Mr. ErnestGunasekera

1999/2000 & 2000/2001

-

Mr. MichaelPeiris

2001/2002 & 2002/2003

-

Mr. LakshmanEdward

2003/2004 & 2004/2005

-

Mr. GayaManamperi

2005/2006 & 2006/2007

-

Mr. ParamaDharmawardene

2007-2010

-

Mr. M.K.Nandasiri

2010/2011

-

Mr. Nilam U.Jumat

2011/2012

-

Mr. JayanthaNewunhella

2012/2013

-

Mr. RanjithHaputhanthri

2013/2014

-

Mr. ThushyDavid

2014/2015 & 2015/2016

-

Mr. ManjulaGunawardana

2016/2017

-

Mr. SusanthaFernando

2018/2019

-

Mr. A.M.S.Kumarasiri

2019/2020 & 2020/2021

-

Mr. LawrianSomanader

2021/2022 & 2022/2023

-: :-

Message From President

It gives me great pleasure and a privilege to pen this message as the president of the Trade Finance Association of Bankers, where we celebrate our Anniversary on yearly basis in a grand note.

This event takes place in Two phases namely the Trade Quiz followed by the grand celebrations of TFAB Anniversary. It is a time to enjoy the Trade Quiz competing with local banking teams where the Quiz master will test the knowledge on Trade Finance and other relevant fields, a time to dance, celebrate and bring the TFAB family together both young and old. We all work together with one motive of making a memorable evening, where all TFAB members could come together in one spirit.

Trade Finance supports any trade business, be it corporate or SME in expanding their global operations while bringing-in Imports and Exports into new market opportunities. It also helps them to manage risks associated with operating in many countries.

Thus, it provides differentiated products in which importers have the privilege to choose from depending on their preferences, marketability and enables the supply chain of diverse exports to global markets for their consumption and usage. Increased trade spells more employment, higher earnings, better productivity, less inflation, and co-operation over confrontation. We also observe that there are trade barriers such as limited access to information and finance, costly requirements, frequent changes in regulations, burdensome customs procedures and lack of trade finance are major hurdles to International Trade.

Companies often struggle to obtain finance including trade finance which constrain their development and opportunities for trade/selling abroad involves various activities ranging from production, products and packaging, marketing to adapting to meet overseas requirements all of which require credit. Inability to provide collateral, guarantees increase higher interest rates and fees and is compounded by the difficulty to access affordable trade finance and lack of financial services further reduces their export potential.

Thus, Trade Finance facilitates establishment of Letters of Credit, DP, DA, Trade loans such as TR and Hypothecation Advances, Pre and Post Shipment Facilities which permit access to enhanced working capital and ensuring uninterrupted operation cycle, mitigating risks confronted during its cycle. Export Credit Insurance and Bank Guarantees safeguard businesses against non-payment risk. National Credit Guarantee Institution is in the form of operationalizing its functions with the support of Ministry of Finance, funded by ADB is another initiative taken to absorb any operational losses which may arise as a result of issuing of Guarantee instruments.

We commenced the operation of TFAB in 1997 with its founder/first president Mr. Kathiravelupillai who inspired with his leadership in forming a council for the purpose of creating an Apex body for trade specialists. Over the years it has grown and ever since then it has been very useful for our members in exchanging views on Trade related scope of work and maintaining consistency in the application of trade practices among member banks.

In this context, we are ever grateful to Mr. Pillai and his council for taking such initiative and the subsequent presidents with the respective councils for preserving and maintaining the spirit of acumen of Trade throughout its journey up to now.

Its Governing authority is vested through the Constitution of TFAB and its addenda issued from time to time. The council under my guidance have been assigned with key performance indicators to all sub committees just as the KPIS that we would set on banking functions and on every monthly meeting we ensure that there is proper coordination and completion of relevant tasks based on a tracker follow up. We also ensure that we discuss a topic relating to Trade Finance in depth, its consequences and we share the essence or the decision with its members every month.

Some of our members do sit in ICC and APB committees which entails many discussions pertaining to ICC opinions on trade-based rules and other business issues as well. This association has molded many trade practitioners to form their general opinions in relation to trade disputes, manage fraudulent scenarios or elevate to ICC opinion as there is lot of vulnerabilities taking place in Trade. We can build capacities of our members so much, so they stand out highlighting themselves against overseas counterparts. Therefore, TFAB has produced many of them with such caliber. Our representation towards regulatory authorities such as Department of Exchange Control, Department of Import and Export Controls, Chambers etc. have been very supportive and often our trade views have been positively taken prior to issuing of certain regulations. We have arranged many training sessions workshops and discussions on topics relevant to our industry/swift /compliance by deploying overseas and local resources to our membership on continuing basis. Annual Visit-to the Colombo port and learning of hub operations in customs in batch wise has been very demanding by our members. We have also launched our TFAB website and currently looking for avenues where we can improve its functionality to provide better quality of service to its members. Our Association works closely with all the stakeholders relevant to the trade business. We have also introduced several Newsletters and publications with the support of the members on quarterly basis in improving their writing skills etc. Cricket sixes was held annually in promoting healthy atmosphere among the membership and allowing for space in fostering their fellowship.

In conclusion, the Trade Finance Association of Bankers in its 26 years journey has played a pivotal role in upscaling the knowledge of trade practitioners, to keep a breast with the latest developments in this dynamic area, while serving the entire nation with its trade concerned requirements.

I take this opportunity to thank everyone who has guided and blessed us in this endeavor. My gratitude goes out to the members of the council and the respective committees who sacrificed much of their personal time and effort in creating value to this Association. This Association is a legacy that needs to be preserved and nourished for future generations. Therefore, I invite all young and old to associate very closely with this association in the years to come. Further I suggest that we introduce continuous improvements to make this Association sustaining in the industry and prosper from strength to strength.

Wishing every one of you the very best.

May TFAB live long with virtues.

President

Trade Finance Association of Bankers

Recent Events

25th Annual General Meeting - 2022

25th Annual General Meeting - 2022

25th Annual General Meeting - 2022Multi Religious Event - 2022

Multi Religious Event - 2022

Multi Religious Event - 2022